Recently I bought a an interesting pharmaceutical play, ビオフェルミン製薬 (Biofermin, 4517). I normally stay away from large(ish) pharmaceuticals because it’s so hard to analyze their patent portfolios, or, more accurately, their patent cliffs. And I actually have worked in pharmaceuticals. Oh yeah, there is one more reason to hate pharmaceuticals in Japan – prices are getting squeezed severely as per-patient budgets come down.

Somewhat of a moat and not that expensive

Having said that, here are the reasons why I bought the co:

1 – It has no patent cliff

2- It does not have to do very expensive clinical trials to release new products

3 – It is 60% a consumer-health products rather than medicines, so it gets some of the moat of a pharma co without all that regulatory cash loss

4 – It just released a special dividend (this is the real reason)

5 – It is not very expensive, even though it has grown over the last few years despite a difficult environment

Company background

This is a subsidiary of大正製薬 (Taisho, 4581), which I think is largest OTC drug company by sales in Japan. Taisho is getting squeezed on costs – but who isn’t? Taisho holds 55.8%of the stock. Sales to Taisho are less than 0.1% of the total.

Products

They basically make lactose bacteria-derived products, and sell them to武田薬品工業 (Takeda, 4502), who is a major shareholder. Their products are used for diarrhea and general GI upsets. Note that Japan has the highest incidence of stomach cancer in the world. Thanks to Yakult Honsha (which, incidentally, is trading at a vomit-inducing 30x times 2014 earnings) there is increasing popularity amongst the public of drinking lactic acid bacteria, and there is much more acceptance of this idea in Japan than anywhere else, as far as I can see. The company says that the lactic acid bacteria drink market is fairly competitive, and will not improve for Biofermin without an improvement in domestic consumption – but they still have massive margins. They export 6% of sales.

They have a lot of different products, which can be split into mass-market products, animal-care products, and medical-targeted products. The largest product by sales is 新ビオフェルミンS (55%), which is a mass-market product, and is growing slightly slower than average. They seem to have larger products growing while they allow smaller ones to die off.

Growth outlook

Although they have managed to grow over the last few years, the outlook is not great in pharma, with continuing price decreases for drugs in Japan (such as 6% mandated for many products last year, although the Biofermin sales prices have been declining by about half that), but it is better, in my opinion, for consumer products (at least with consumer products there is the prospect of growth in health drink consumption, particularly if personal consumption ever gets better) – having said that, their consumer products have been growing slower than their overall sales for the last year or so. They’re trying to deal with this overall sluggish background by carrying out internal and collaborative research, growing in less price-sensitive products, and by rationalizing costs (a bit like every other company in Japan). Note that they decreased the depreciation in the last year, so if you take that out, net income would have been lower by 136 Million yen. However, in the last few quarters both sales and income have been growing.

Balance sheet & cash usage

They have 8 billion yen of cash and 3 billion yen of total liabilities. Their current assets are almost 14 billion yen, of which their receivables (around 4 billion) are all with one company which will have no problem in paying.

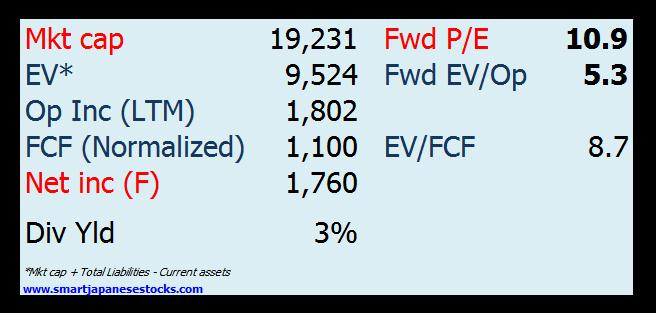

The dividend policy is for a payout ratio of 55%. However, they recently announced a one-off dividend payment celebrating the 95th year of their establishment. There were rumours that they might pay such a dividend, and, thinking that I was clever, I bought the rumour (but did not sell the fact – doh!). Note that the div yield above will revert back to about 2%. In the last year, if you look at their fin statements, you will notice that their capex has gone up, but this is because of building a new factory in Kobe, and their normal run rate is less than 1 billion yen. A stable state free cash flow is hard to pin down because they have so many moving parts, but I would guess it to be 1 billion yen, which is great relative to a 10 billion yen EV, and there are better bargains in Japan.

Is it worth it?

So basically, the deal here is that you have a company with a fairly good moat and growth track record trading at an OK multiple. Note that Takeda itself is trading at something like 15 times next year’s earnings while its profit performance is abysmal. Meanwhile, Taisho, which has modest single-digit top line growth, is about 20x.

I should also note that there is a regulatory risk due to Japanese healthcare reform- the risk is that there are greater restrictions placed on biological drugs and on the sale of biological products, and this is difficult to quantify. Overall, it is a relatively cheap but objectively somewhat expensively-priced company with a moderate moat (and high margins), operating in two industries: one which is undergoing regulation-mandated price drops, and the other facing potentially higher competition. The logical response would be to model reduced margins going forwards, but my response to that is the company has gone through a period of really bad consumer entrenchment, and yet has grown sales and margins. I would model either flat margins and no growth, in which case you look at it like a bond, or declining margins plus top line growth, in the case that its consumer products outgrow the medical portion. Am I still trying to sell this to myself?

Benjamin Graham throws me out of class

I cannot get conviction on this stock. Benjamin Graham would be angry at me. I got excited by a dividend increase, sold it to myself on the relative valuation idea, then bought the rumour but forgot to sell the fact. A lack of discipline is a major flaw. If someone hands you a map marked with pots of gold crosses (the Japanese stock market), you (specifically, I) need to take all measures necessary to avoid getting distracted by the donut shop.

{ 0 comments… add one now }